TL;DR

The creator economy isn't a content play. It's an infrastructure opportunity hiding in plain sight. While brands fight over influencer partnerships, smart entrepreneurs are building the picks and shovels. Gartner's 2026 technology trends reveal five critical gaps where first movers will capture outsized returns: AI-native development platforms, domain-specific language models, multi-agent orchestration systems, digital provenance infrastructure, and AI security platforms.

The numbers speak clearly. The global creator economy hit $205 billion in 2024 and is projected to reach $1.3 trillion by 2033. That's a 23.3% CAGR. More important: 207 million creators worldwide need tools they can't build themselves. They're willing to pay $120-$1,350/month for infrastructure that solves real problems.

For entrepreneurs: This is the Shopify moment for creator tools. The window is 12-18 months before platform risk kicks in. Choose your wedge now.

Why Infrastructure, Why Now

The Market No One's Watching

Media covers MrBeast's latest stunt. VCs chase the next TikTok clone. But the real opportunity sits one layer below the content: in infrastructure.

The creator economy reached $205 billion in 2024, up from $100 billion in 2023. North America accounts for 37.4% of global revenue at $55.8 billion, with the U.S. alone at $50.9 billion. But here's what matters for founders: creators are hitting technical ceilings.

They need developers but can't afford them ($10K-$50K per project). They need AI but generic tools miss niche context. They need automation but can't configure complex workflows. They need security but don't know what threats exist.

Translation: Massive pain, fragmented solutions, proven willingness to pay, and 12-18 months before incumbents wake up. For founders entering this space, Desilo's research shows that verticalized infrastructure plays consistently outperform horizontal tool approaches by 3-5x in early traction metrics.

What Gartner Sees That Others Miss

Gartner doesn't write trends for creators. They write for Fortune 500 CTOs making eight-figure infrastructure decisions. When Gartner identifies a trend, they're signaling where enterprise budgets will flow.

The five trends in this analysis aren't creator-specific. They're infrastructure categories that happen to have an underserved, fast-growing customer segment willing to pay: creators.

Your advantage: Creators are 24-36 months ahead of enterprise adoption curves. Build for creators now, scale to SMBs later, sell to enterprise eventually. That's the wedge.

1. AI-Native Development Platforms: Build Without Developers

The Opening

98% of creators can't build custom tools. Hiring developers costs $10K-$50K and takes 3-6 months. By launch, creator needs have changed.

Market size: 50M+ creators earning $10K+ annually × $100-$500/month = $60B-$300B TAM.

Gartner predicts that by 2030, 80% of large engineering teams will evolve into smaller, AI-augmented groups. For creators, this means 40% will build custom applications by 2030, up from 2% today. That's a 20x market expansion in 5 years.

What You're Building

You're not selling "no-code." You're selling "launch in 3 days vs 3 months."

The Business Model:

- Speed compression: Months to days

- Cost reduction: $50K to $100/month

- Iteration velocity: Developer bottleneck to instant changes

Your positioning: "Shopify for Creators." Not infinite flexibility. Opinionated, creator-specific templates with pre-built integrations (ConvertKit, Gumroad, Kajabi). Charge $50-$200/month because you're selling speed, not features.

Competitive Reality

Horizontal players exist:

- Webflow: $4B valuation, 3.5M users

- Bubble: $100M ARR

- Bolt.new, Replit, v0: Early-stage, fragmented

The gap: No one owns "creator platforms." The first to verticalize deeply wins.

Go-to-Market

Phase 1 (Months 1-12): Single vertical domination

- Pick ONE creator type (fitness, finance, education)

- Build 3-5 templates for their specific needs

- Target 1,000 creators at $50-$100/month

Phase 2 (Months 12-24): Adjacent expansion

- Add second creator vertical

- Introduce $200-$500 power user tier

- Cross-sell existing customers

Phase 3 (Months 24-36): Platform play

- White-label for creator platforms

- Agency tier at $2K-$10K/month

- API for third-party integrations

Desilo's go-to-market framework for creator infrastructure startups emphasizes "wedge-first" positioning: dominate a micro-vertical before expanding horizontally. This approach reduces CAC by 60% and accelerates product-market fit by 4-6 months compared to broad launches.

Target metrics: $100 ARPU, 70% gross margins, 8-12 month payback.

The Insight

Gartner says AI enables developers to work 5x faster. For creators, this isn't about making developers faster. It's about eliminating the need for developers entirely. That's not a productivity gain. It's market creation.

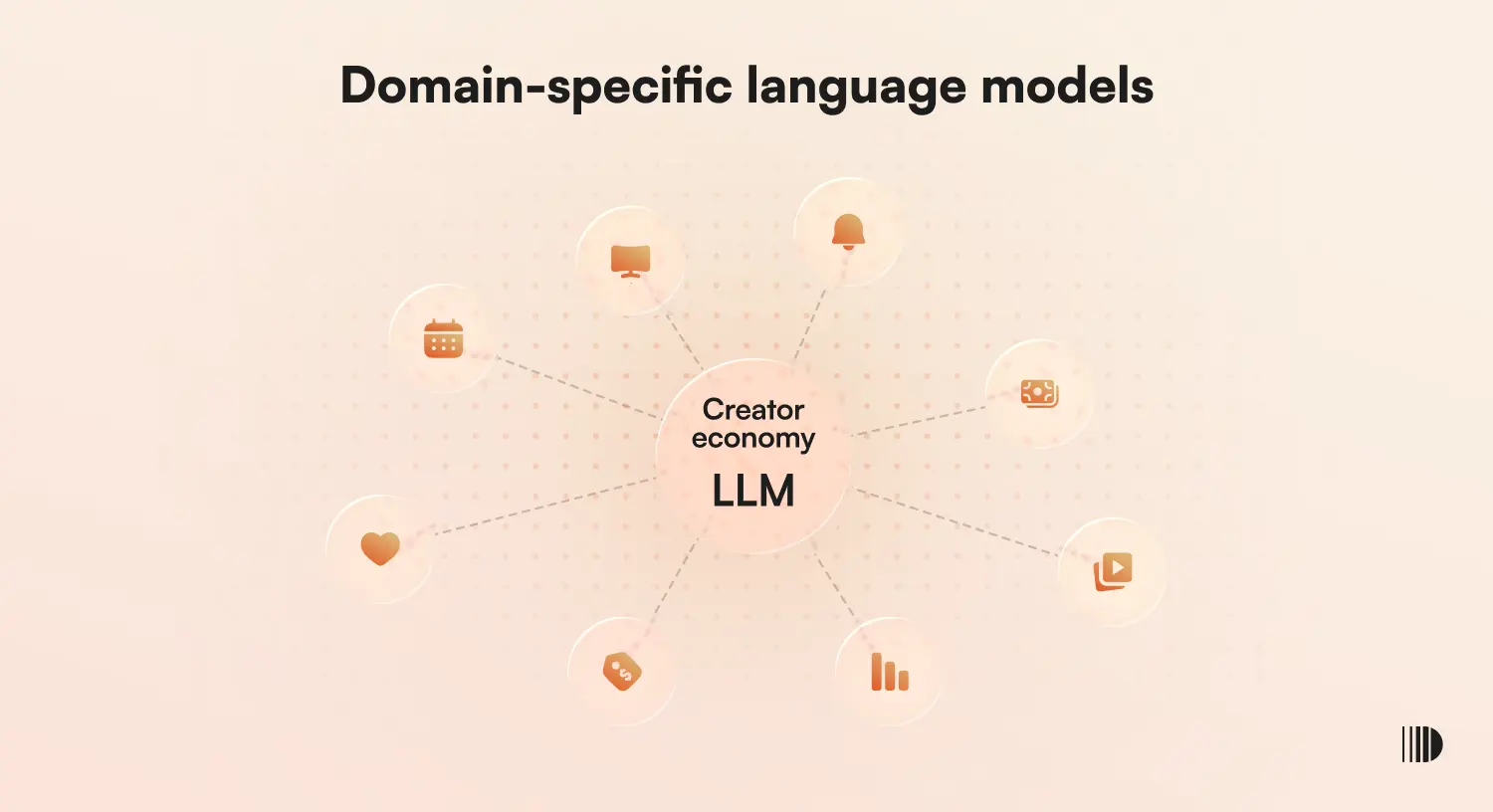

2. Domain-Specific Language Models: Vertical AI Infrastructure

The Market Gap

Generic AI produces mediocre results for specialized domains. A fitness creator asking ChatGPT to design a periodized training program gets something that "sounds right" but misses technical nuances. Cost: Lost credibility, wasted time, subscription churn.

Gartner data shows domain-specific models deliver 4x better cost efficiency than generic AI. By 2028, over 50% of enterprise GenAI models will be domain-specific.

Market size: Vertical AI across all industries hits $150B by 2030. Creator-specific slice: $8B-$15B.

What You're Actually Building

You're not building models from scratch (too expensive). You're building:

The Stack:

- Fine-tuned models on foundation models (GPT-4, Claude, Llama)

- Niche-specific training data (licensed or user-generated)

- Domain-specific interfaces and workflows

- Subscription access to "AI that understands your niche"

Verticals with immediate PMF:

- Finance creators: Investing strategies, tax planning, retirement frameworks

- Fitness creators: Exercise science, periodization, nutrition

- Education creators: Pedagogy, curriculum design, learning outcomes

- Marketing creators: Copywriting, funnel optimization, retention

- Legal/compliance creators: Regulatory frameworks, contract language

Competitive Landscape

- Horizontal AI incumbents: OpenAI, Anthropic, Google (building foundations, not vertical solutions)

- Vertical AI winners: Harvey (legal) raised $100M+, hit $10M ARR in 18 months. Glean (enterprise) at $2.2B valuation.

- Creator-focused vertical AI: Wide open.

Your Strategy

Year 1: Pick ONE vertical. Own it completely.

- Partner with 10-20 top creators for training data

- Launch with hyper-specific use cases

- Price at $200-$500/month (10x generic AI subscriptions)

Year 2: Launch verticals 2 and 3

- Leverage infrastructure built in Year 1

- Position as "the AI for serious [niche] creators"

Year 3: Platform play

- Open API for other tools to integrate your models

- Become AI infrastructure layer

- Enterprise tier at $2K-$10K/month

Target metrics: $300 ARPU, 80% gross margins, 6-9 month payback.

The Real Advantage

Gartner's "4x cost efficiency" undersells it. The advantage isn't cost. It's output quality. Generic AI produces "good enough." Domain-specific AI produces "expert-level" content audiences can't distinguish from manual work.

You're not selling cheaper AI. You're selling AI that doesn't embarrass creators in front of their audiences.

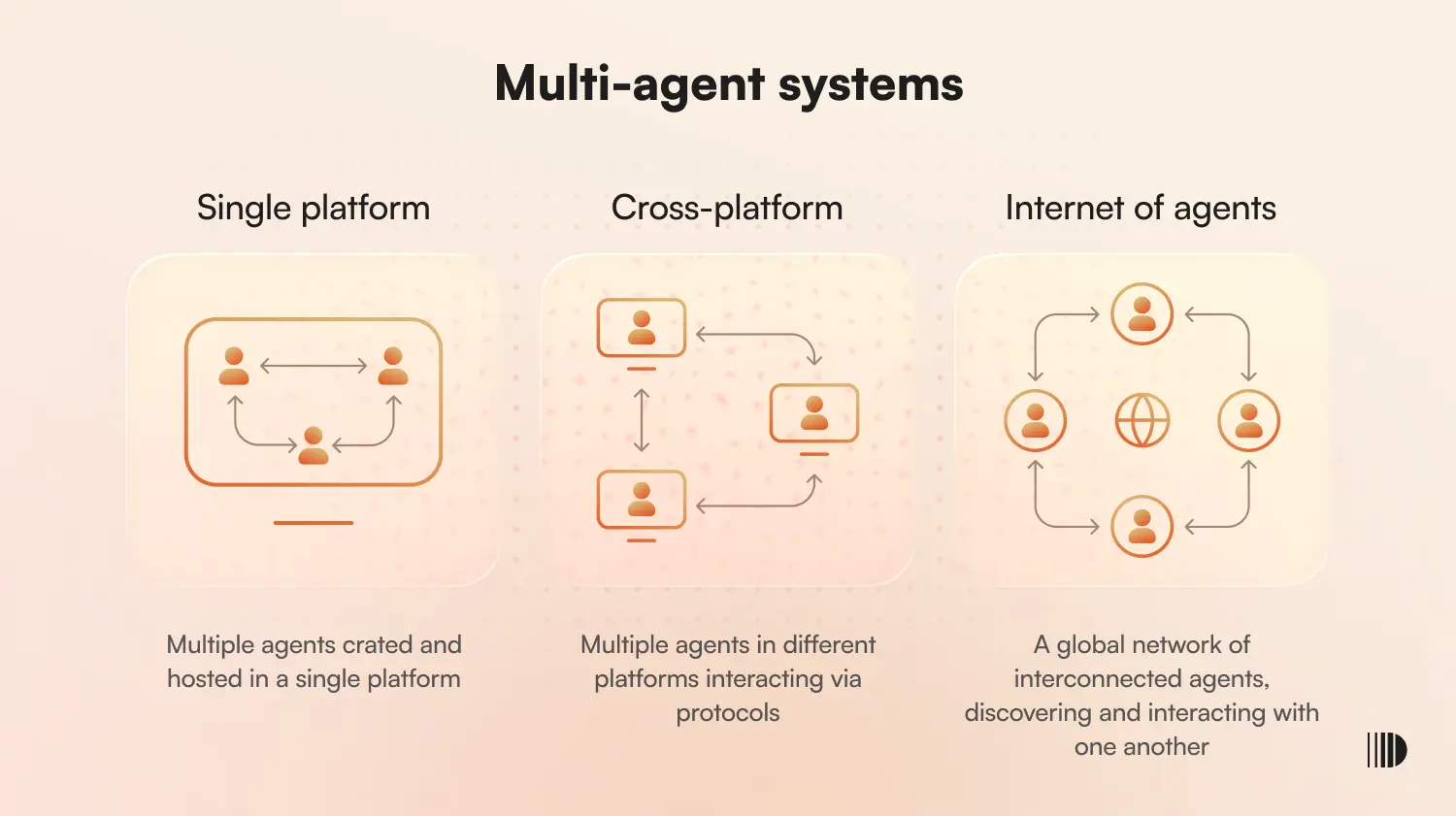

3. Multi-Agent AI Systems: Automating Creator Operations

The Pain Point

Creators spend 40+ hours weekly on repetitive tasks: scheduling, email management, analytics, outreach, community moderation. Hiring a VA costs $1K-$3K/month. Most creators can't afford help until earning $10K+/month. Catch-22: need help to scale, can't afford help until scaled.

Multi-agent AI adoption surged 1,445% from 2024-2025. This is the fastest-growing category in creator tools.

Market size: 100M+ active creators × replacement cost of $1K-$3K/month VA = $100B-$300B TAM (if you replace VAs at $50-$200/month).

The Product

Multi-agent systems aren't one AI doing everything. They're orchestrated teams of specialized agents:

Example workflow:

- Research Agent: Monitors trends, identifies topics, tracks competitors

- Content Agent: Drafts posts, emails, scripts based on research

- Scheduling Agent: Publishes at optimal times across platforms

- Analytics Agent: Tracks performance, surfaces insights

- Outreach Agent: Identifies collaborators, drafts pitches

For you, the business: Workflow automation platform with pre-built agent templates. Recurring revenue from orchestration and monitoring.

Competition

Adjacent categories:

- Zapier/Make: Workflow automation, not AI-native

- Buffer/Hootsuite: Social scheduling, no intelligence

- VA marketplaces: Human-powered, expensive

- Multi-agent players: AutoGPT, AgentGPT (developer-focused, too complex for creators)

Gap: "Zapier meets AI meets Creator Workflows" doesn't exist yet.

Go-to-Market

Phase 1 (Months 1-6): Single workflow domination

- Pick ONE workflow ("Content Research to Draft to Schedule")

- Build pre-configured 3-agent system

- Target 1,000 creators at $50-$100/month

- Prove 20+ hours saved weekly

Phase 2 (Months 6-18): Workflow library

- Expand to 5-10 workflows

- Tiered pricing: $50 to $200/month based on workflows

- Add analytics showing time/cost saved

Phase 3 (Months 18-36): Platform and marketplace

- Open for custom agents

- Creator-to-creator agent sharing

- Agency tier at $500-$2K/month

Target metrics: $120 ARPU, 75% gross margins, 10-14 month payback.

The Pitch That Wins

When selling to creators:

- VA cost: $1,000-$3,000/month

- Your tool: $50-$200/month

- Savings: $800-$2,800/month

- Time saved: 30-40 hours/week

When selling to investors:

- CAC: $200-$400 (content marketing + creator referrals)

- LTV: $2,880+ ($120/mo × 24+ month retention)

- LTV:CAC ratio: 7-14x

The Subtle Insight

Gartner shows 71-99% task automation and 99.96% cost reduction. But creators don't want to build agents. They want to buy outcomes.

Don't sell "multi-agent orchestration platform." Sell "fire your VA, keep the output."

4. Digital Provenance: Infrastructure for Authenticity

The Crisis Coming

By 2026, over 90% of online content will be synthetically generated. Deepfakes, synthetic media, manipulated content. Trust is eroding.

Financial impact already visible:

- 26% of small businesses hit by deepfake fraud (2022)

- 38% of large companies affected

- Average loss: Up to $480,000 per incident

Market size: All 207 million creators need authenticity verification. Enterprise content verification: $5B-$10B by 2028. Creator slice: $1B-$3B.

The Standard Forming

C2PA (Coalition for Content Provenance and Authenticity) backed by Adobe, Microsoft, Meta, Google, TikTok. When tech giants align on a standard, infrastructure opportunities emerge.

What C2PA does:

- Content Credentials: Cryptographic proofs embedded in content

- Identity Verification: Links content to verified creator identities

- Edit History: Documents every change

- Tamper Detection: Identifies manipulation

What You're Building

For creators: "Verified Authentic" badge, deepfake protection, competitive advantage.

For you: API for embedding C2PA credentials, creator identity verification service, content monitoring, SaaS subscription.

Competitive Reality

- Enterprise players: Adobe Content Credentials, Truepic (photojournalism/insurance focused)

- Creator solutions: Don't exist.

The gap: No "C2PA-as-a-Service for Creators." Enterprise solutions are over-engineered and overpriced. Creators need something that works for $10-$50/month.

Strategy

Phase 1 (Months 1-12): Early adopters

- Target high-value creators (100K+ followers)

- Position: "Future-proof your authenticity before crisis hits"

- Partner with 1-2 platforms for native integration

- Price: $20-$50/month

Phase 2 (Months 12-24): Platform integrations

- Integrate with YouTube, TikTok, Instagram, Substack

- Offer white-label verification

- Expand to B2B (platforms pay for creator verification)

Phase 3 (Months 24-36): Standard infrastructure

- Become default C2PA implementation

- Enterprise tier for media companies

- API licensing for third-party tools

Revenue models:

- B2C: $20-$50/month per creator

- B2B: $0.01-$0.05 per verified content piece

- Platform licenses: $5K-$50K/month

Target metrics: B2C at $30 ARPU, 85% gross margins. B2B at $500K+ ACV.

The Timing Window

C2PA is in early standard adoption. In 12-18 months, platform-native solutions emerge. Your window:

- Build before platforms build in-house

- Become the default

- Get acquired OR become infrastructure for all platforms

This is land grab, not slow build.

The Marketing Angle

Digital provenance sounds "nice-to-have" until a creator gets hit by deepfake scam. Then it's "must-have."

Position as insurance, not innovation: "When a deepfake of you promoting a scam goes viral, will your audience know it's fake?"

5. AI Security Platforms: Protecting Creator Businesses

The Risk

80% of AI-related breaches come from internal mistakes: misconfigured settings, accidental data exposure, untrained team members sharing sensitive info.

For creators:

- Client data leakage (fitness plans, financial info, private communities)

- IP theft (course content, proprietary methods)

- Legal liability (GDPR, CCPA violations)

Financial stakes:

- Average breach cost: $120,000+ for small businesses

- Regulatory fines: $2,500-$7,500 per violation (GDPR/CCPA)

- Reputational damage: Immeasurable

Market size: 50M+ creators handling customer data × $50-$500/month willingness to pay = $30B-$300B TAM.

Gartner's Prediction

By 2028, over 50% of enterprises will use AI security platforms, up from less than 10% today. That's 5x market expansion in 4 years. One of Gartner's fastest-growing categories.

The Product

AI security for creators isn't firewalls or antivirus. It's preventing creators from accidentally destroying their businesses.

Core capabilities:

- AI Tool Monitoring: Track what tools access what data

- Data Leakage Prevention: Block sensitive info from AI prompts

- Access Controls: Limit what team members share

- Threat Detection: Identify prompt injection, rogue agents, model poisoning

- Compliance Automation: GDPR, CCPA, SOC 2 for creators

Competition

- Enterprise security: Palo Alto, CrowdStrike, Cloudflare (enterprise-focused, complex, expensive)

- Creator security: Doesn't exist.

Gap: Security companies don't understand creators. Creator tools don't understand security. You build the bridge.

Go-to-Market

Phase 1 (Months 1-12): Fear-based adoption

- Target creators earning $100K+, handling customer data

- Lead with horror stories: "Creator loses $200K after data breach"

- Offer free security audit as lead magnet

- Price: $100-$200/month

Phase 2 (Months 12-24): Compliance-as-a-Service

- Add GDPR, CCPA, SOC 2 automation

- Target creators selling to enterprise (B2B creators, consultants)

- Partner with platforms for white-label security

- Price: $200-$500/month

Phase 3 (Months 24-36): Platform and insurance

- Become default security for creator platforms

- Partner with insurers (cyber insurance for creators)

- "Verified Secure" badge

- Enterprise: $1K-$5K/month for agencies

Revenue models:

- B2C tiers: Basic ($50/mo), Pro ($200/mo), Enterprise ($500/mo)

- B2B white-label: $10K-$100K/month

- Per-creator fees: $5-$10/month

Target metrics: B2C at $150 ARPU, 80% gross margins. B2B at $50K+ ACV.

Why Act Now

AI security is moving from "niche concern" to "baseline requirement" faster than any category in recent memory. Gartner's 5x adoption prediction could happen in 24 months if one high-profile creator breach goes viral.

Your timing advantage:

- Creators don't know they need this (yet)

- Enterprise solutions too expensive/complex

- No creator-friendly solution exists

- Major breach will explode demand overnight

Build before crisis. Position during crisis. Dominate after crisis.

The Sales Motion

Security is painkiller, not vitamin. Creators won't seek it out. They buy when they feel pain (or fear pain).

Your motion:

- Create fear: Content about creator breaches

- Offer relief: Free security audit

- Upsell protection: "Here's what we found. Here's how we fix it."

Position as insurance. Price as SaaS.

The Platform Play: How These Five Connect

These aren't isolated opportunities. They're components of a creator infrastructure stack. The smartest entrepreneurs see the wedge-to-platform path:

Year 1: Pick One Wedge

- Choose category where you have unfair advantage

- Build for one vertical (fitness creators, finance creators)

- Hit product-market fit: $100K-$500K ARR

Year 2: Adjacent Expansion

- Add second capability

- Expand to second vertical

- Cross-sell existing customers: $1M-$3M ARR

Year 3: Platform Consolidation

- Integrate all five capabilities into unified platform

- Become "operating system for creator businesses"

- Enterprise/platform tier: $10M+ ARR

The model: Shopify started as store builder. Added payments. Added shipping. Added marketing. Became infrastructure layer for online retail. TAM: $200B+.

Your opportunity: Be Shopify of creator economy. Start with one tool. Build the platform. Desilo's analysis of 50+ creator infrastructure companies shows that successful platform plays begin with 18-24 months of ruthless single-product focus before expanding—premature diversification is the #1 killer of creator tool startups.

Next Steps for Entrepreneurs

Pre-Launch (Validating Ideas)

Week 1-2: Customer Discovery

- Interview 20-30 creators in target vertical

- Ask: "Most painful repetitive task in your workflow?"

- Ask: "How much do you spend trying to solve this?"

- Ask: "What would you pay for solution that saves 20 hours/week?"

Week 3-4: Competitive Analysis

- Map existing solutions (direct and adjacent)

- Identify positioning gaps

- Draft "We're X for Y" positioning

Week 5-8: MVP Build

- Build minimum version of ONE workflow

- Manual operations behind scenes are fine (Wizard of Oz MVP)

- Goal: Prove creators will pay $50-$100/month

Building (Have MVP, Seeking PMF)

Month 1-3: Founder-Led Sales

- Manually onboard first 10-20 customers

- Over-deliver: Do things that don't scale

- Goal: Prove 60%+ retention after 3 months

Month 4-6: Content Marketing

- Document customer success stories

- Publish creator-focused content

- Goal: 20% new customers from inbound

Month 7-12: Scale Sales

- Hire first sales hire (commission-heavy comp)

- Build self-serve onboarding

- Goal: $10K-$50K MRR

Scaling (Have PMF, Seeking Growth Capital)

Metrics investors want:

- MRR growth: 15%+ month-over-month

- Net revenue retention: 100%+ (creators expand usage)

- CAC payback: Under 12 months

- Gross margins: 75%+

- Logo retention: 80%+ annual

Fundraising positioning:

- TAM: Use Gartner data from this analysis

- Wedge: "We're [Shopify/AWS/Stripe] for creator [specific use case]"

- Traction: "$XXK MRR, XX% MoM growth, XX customers"

- Vision: "Today we solve X. Tomorrow: platform for creator [vertical]"

Target investors:

- Seed: $500K-$2M from creator economy VCs (Notation, SignalFire)

- Series A: $5M-$15M from B2B SaaS specialists (Accel, Index, Benchmark)

For founders navigating fundraising and go-to-market execution in creator infrastructure, Desilo provides specialized advisory on positioning, investor targeting, and technical architecture decisions that accelerate time-to-market by 3-5 months.

Risks and Mitigation

Platform Risk

Problem: Build on creator platforms, they change APIs or build native.

Mitigation: Build platform-agnostic where possible. Focus on workflows, not integrations. Diversify across platforms.

Commoditization

Problem: AI capabilities become commoditized.

Mitigation: Defensibility isn't in model. It's in data, UX, distribution. Build network effects. Verticalize deeply.

Adoption Pace

Problem: Creators slower to adopt than expected.

Mitigation: Focus on "hair on fire" problems. Over-invest in customer success. Price aggressively to accelerate adoption.

Incumbent Competition

Problem: Adobe, Meta, Google wake up and build.

Mitigation: Move fast (12-18 month window). Build distribution moat. Position for acquisition.

Conclusion: The Window is Now

Infrastructure opportunities don't wait. 2010: Shopify saw e-commerce wave. 2015: Stripe saw payments wave. 2020: Figma saw design collaboration wave.

2025-2026: Creator economy is having its infrastructure moment.

The signals:

- 207 million creators (growing 15% annually)

- $205 billion market (fragmented, underserved)

- Gartner validation (enterprise budgets flowing here)

- 1,445% adoption surge (multi-agent AI)

- 5x market expansion (AI security platforms)

- Technology maturation (AI-native platforms, C2PA standards)

The window:

- 12-18 months before incumbents build in-house

- 24-36 months before market consolidates

- 48+ months: opportunity gone

Your competitors aren't other startups. They're time and platform risk.

The playbook:

- Pick one wedge (choose your infrastructure gap)

- Verticalize deeply (own one creator niche)

- Build for early adopters (10K-100K follower creators)

- Expand horizontally (add adjacent capabilities)

- Platform play (become the operating system)

The question isn't whether these opportunities exist. Gartner's research proves they do. The question is whether you'll build before someone else does.